BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

Simplifying Medical Billing with Accuracy & Efficiency

Schedule a CallTotal Appointments Scheduled

Clean Claim Rate

Patient Collection Rate

ASP-RCM Solutions specializes in accurate medical billing, seamless claims processing, and practical financial management to support patients and healthcare providers.

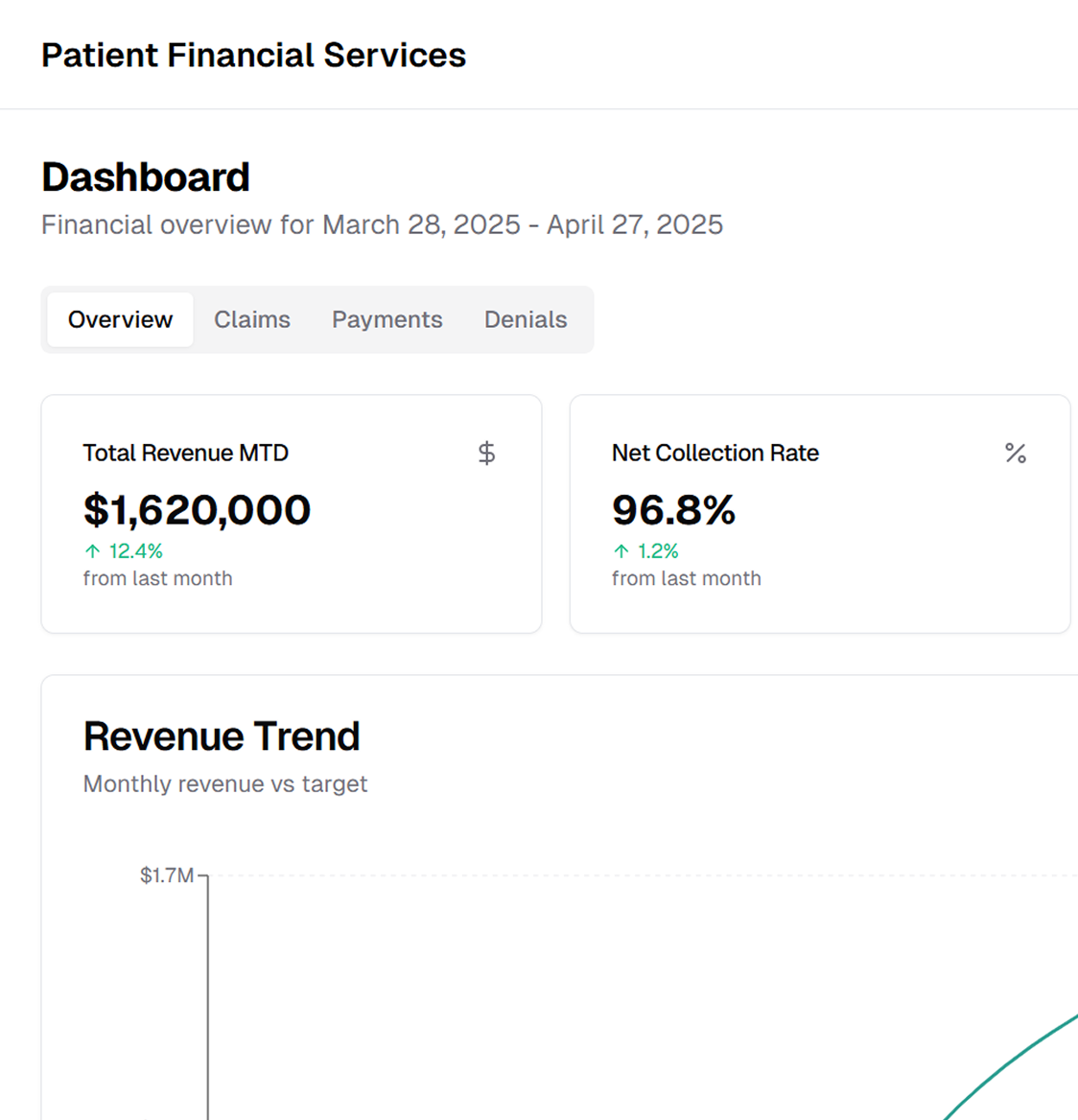

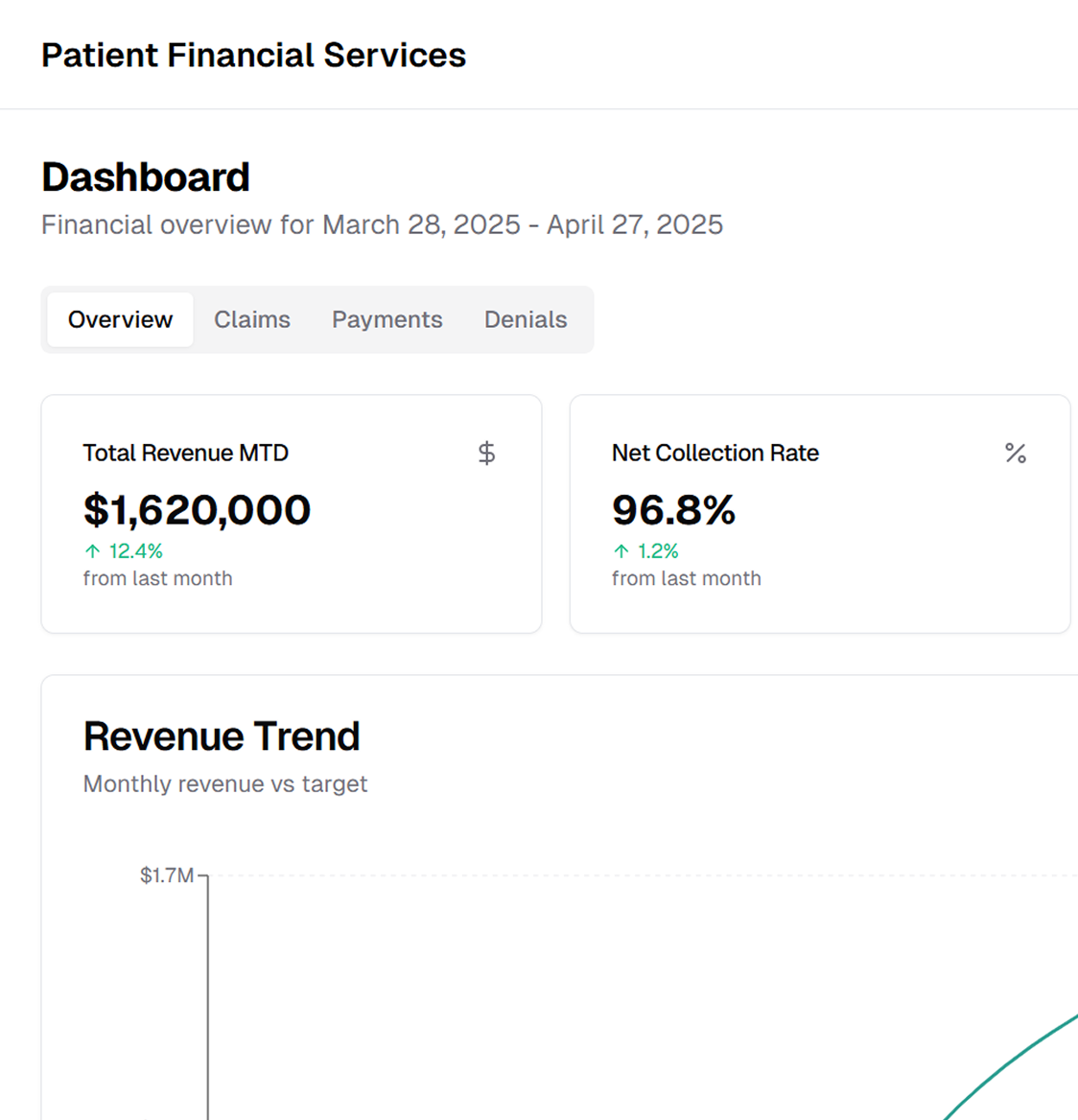

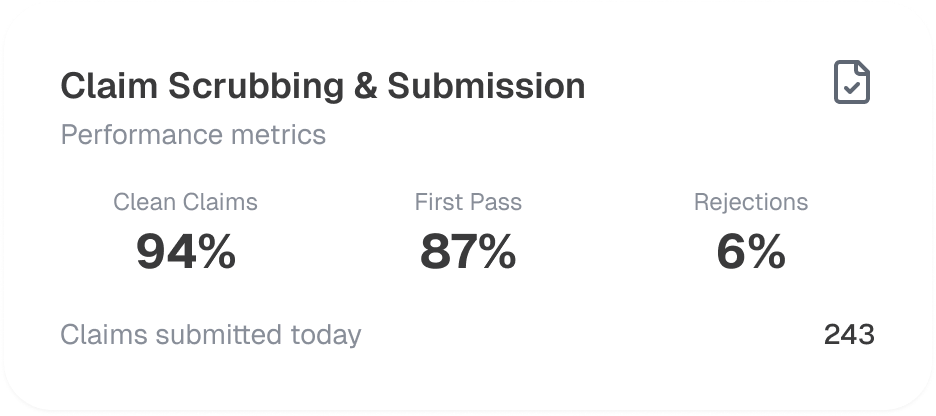

We handle the medical billing, from charge capture and claim submission to payment posting and follow-up. Our structured approach minimizes errors, reduces rejections, and maximizes reimbursements for healthcare providers.

Before service delivery, we conduct real-time eligibility verification (270/271 transactions) and pre-authorization processing to confirm coverage details, co-pays, deductibles, and out-of-pocket expenses. Our payer connectivity solutions help reduce claim rejections due to coverage issues.

We provide denial tracking, root cause analysis, and appeal submission to minimize revenue loss. Our structured Denial Management Workflow (DMW) includes automated follow-ups, reconsideration requests, and Level 1 and Level 2 appeal submissions based on Explanation of Benefits (EOB) and Claim Adjustment Reason Codes (CARC).

Our financial counselors assess patient eligibility for Sliding Fee Scale (SFS) programs, charity care, and government-sponsored plans such as Medicaid & Medicare. To improve self-pay recoveries, we offer structured patient payment plans, Health Savings Account (HSA) integration, and point-of-service (POS) collections.

We ensure compliance to HIPAA (Health Insurance Portability and Accountability Act), CMS (Centers for Medicare & Medicaid Services) regulations, and payer-specific guidelines. Our compliance checks include National Correct Coding Initiative (NCCI) edits, Local Coverage Determinations (LCDs), and Medicare Secondary Payer (MSP) validation to prevent fraud, waste, and abuse.

With a focus on revenue integrity, cash flow optimization, and payer coordination, our billing solutions integrate with Electronic Health Records (EHR), Clearinghouses, and Practice Management Systems (PMS) for seamless financial transactions.

We utilize payer-specific edits, National Provider Identifier (NPI) validation, and Place of Service (POS) code mapping to ensure clean claim submissions (837P/837I transactions) and reduce rejections from Medicare, Medicaid, and commercial payers.

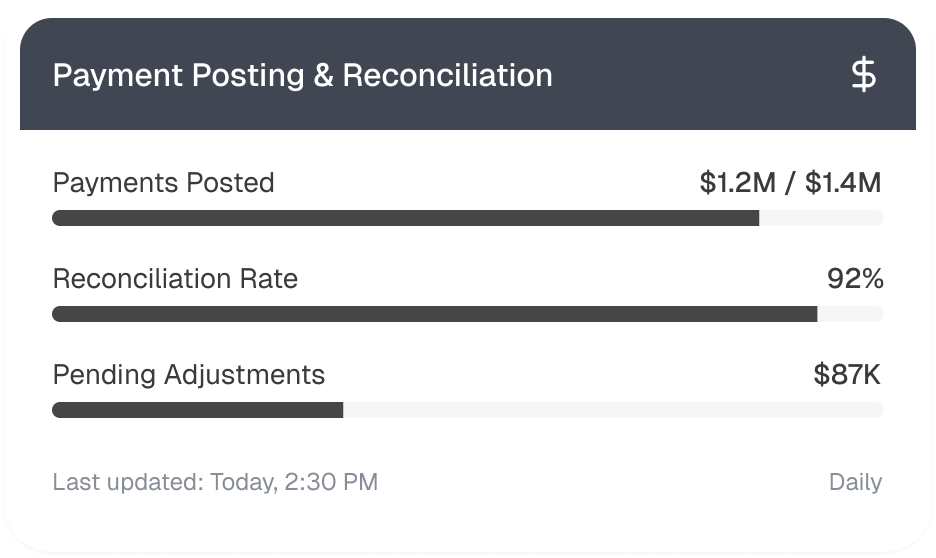

Our team processes Electronic Remittance Advice (ERA 835) and manual payment postings with auto-reconciliation to General Ledger (GL) and Payment Variance Analysis (PVA) to identify underpayments and prevent revenue loss.

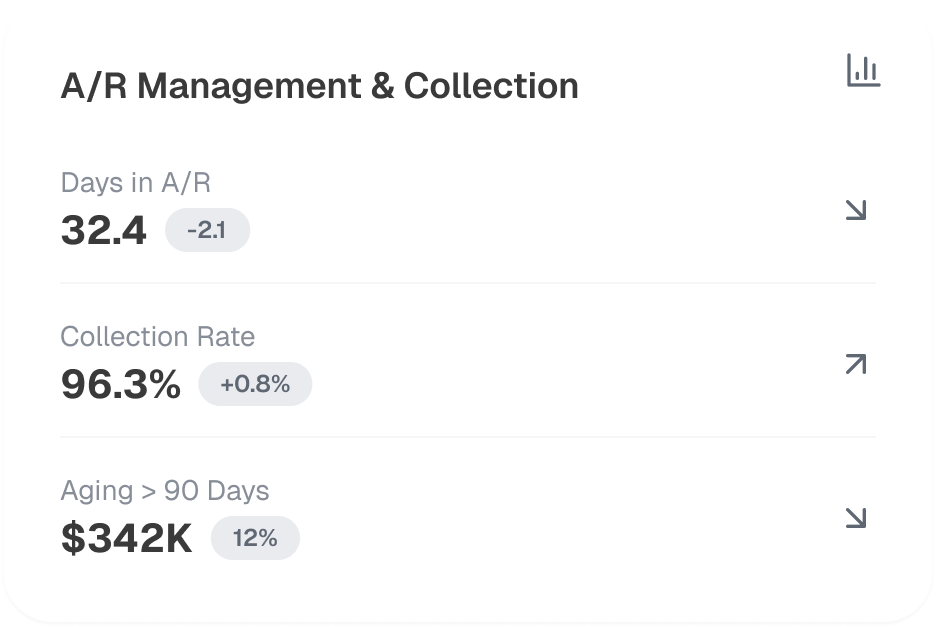

We perform aging analysis, payer follow-ups, and timely secondary & tertiary billing to maintain a low Days Sales Outstanding (DSO) and reduce A/R aging beyond 90 days. Our Key Performance Indicators (KPIs) tracking helps providers improve collections.

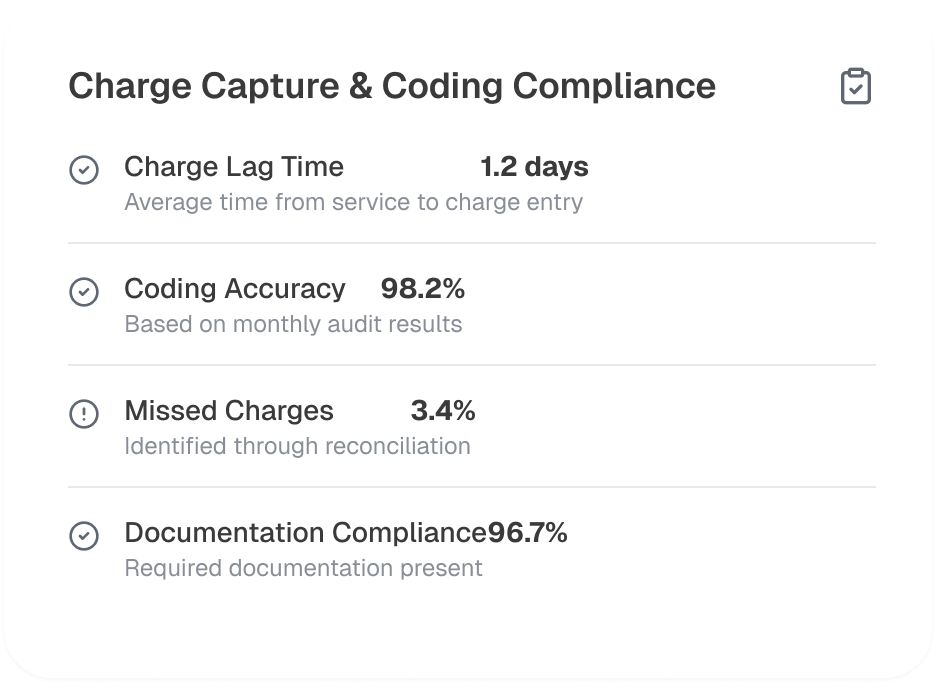

Our certified coders (CPC, CCS, RHIT) perform Modifier Validation, Medical Necessity Checks, and Risk Adjustment Factor (RAF) calculations to ensure accurate coding and maximize reimbursements.

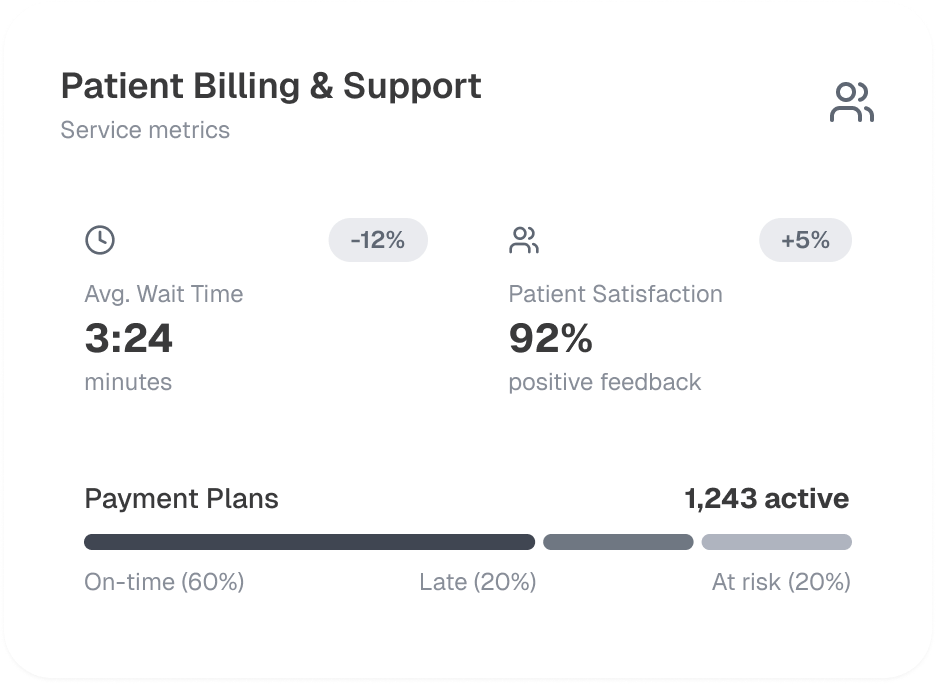

We offer dedicated patient support for billing inquiries, payment disputes, and refund processing through IVR-based helplines, secure patient portals, and 24/7 customer service teams to enhance patient experience.