BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

We thrive on finding practical solutions to billing challenges. Our commitment is simple: to turn every billing obstacle into a strategic solution

Schedule a CallTotal Claims Submitted

Claim Approval Rate

Avg Reimbursement Time

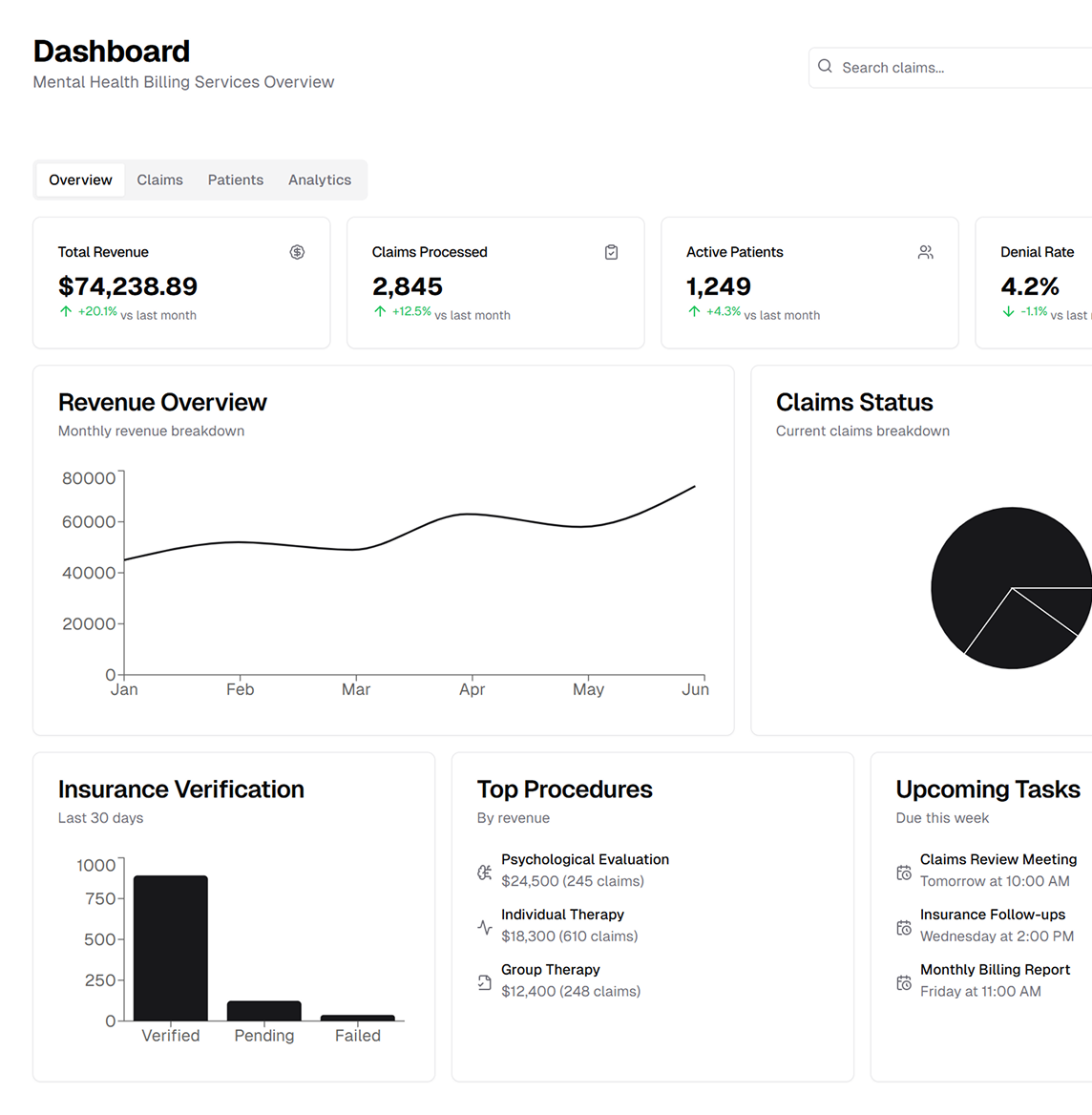

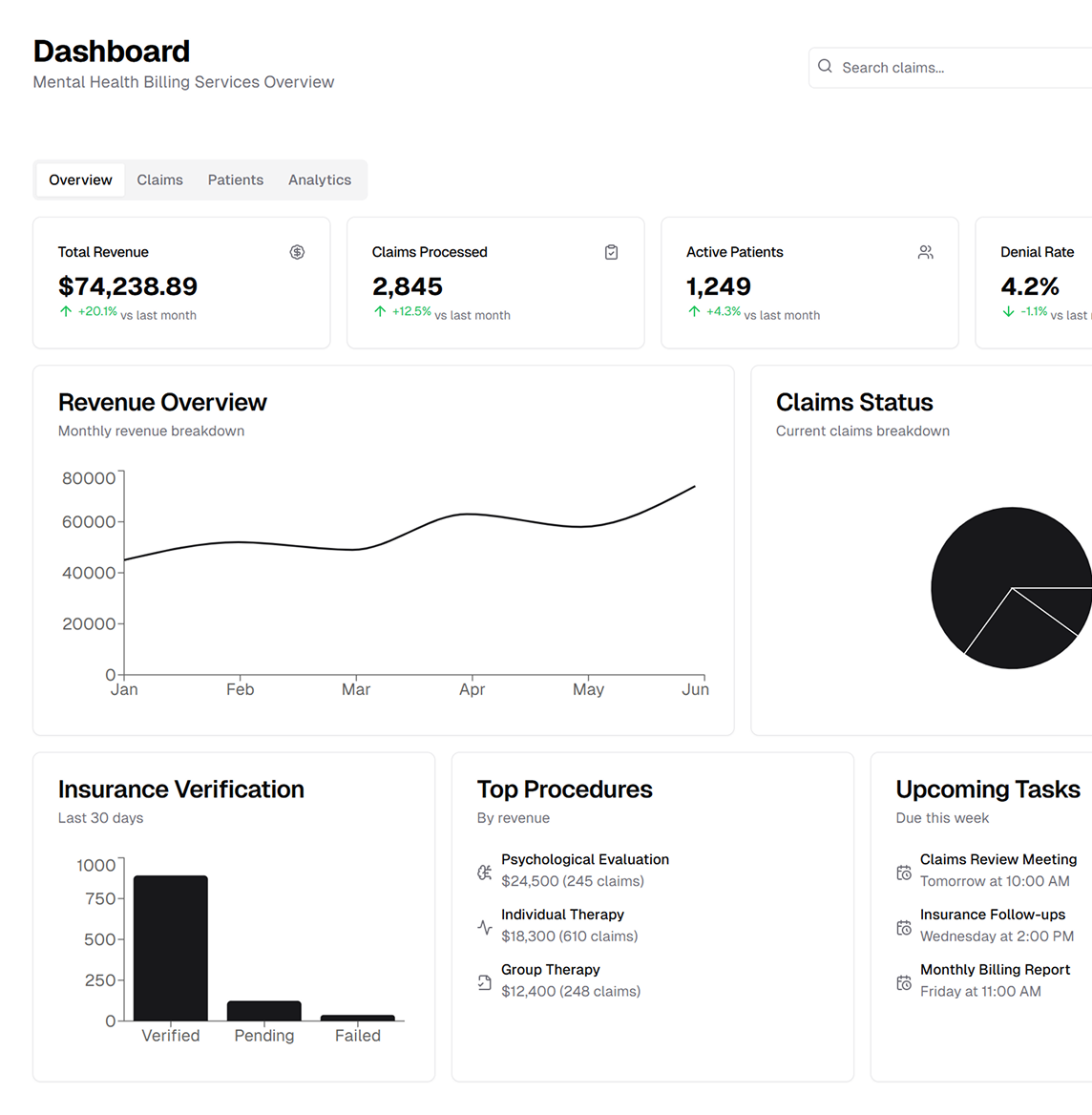

ASP‑RCM handles all aspects of mental health billing, from evolving payer guidelines and coverage mandates to fee schedule reimbursements. By staying current on regulatory changes, we ensure you can focus on what matters most—delivering patient‑centric care

Payer directives and regulations are always in flux. Our team diligently monitors new policies and state or federal coverage requirements so that your mental health practice never misses an update, ensuring timely, accurate reimbursements

Clean claim submission is at the heart of our approach. Our billing specialists undergo continuous training and audits to avoid errors and reduce claim denials. By guaranteeing accurate and complete claims, we help secure faster insurance payouts

Our AAPC-certified coders handle mental health billing with expertise in therapy codes and 10+ years of RCM experience

We manage patient intake, benefit verification, prior authorization, EMR charge review, and efficient claims transmission, achieving a 95% first-pass acceptance rate to boost reimbursement and reduce DAR

From ERA/EOB posting to self-pay tracking, our post-billing process ensures accurate payment reconciliation, flags discrepancies, and delivers transparent patient invoicing to prevent revenue leaks.

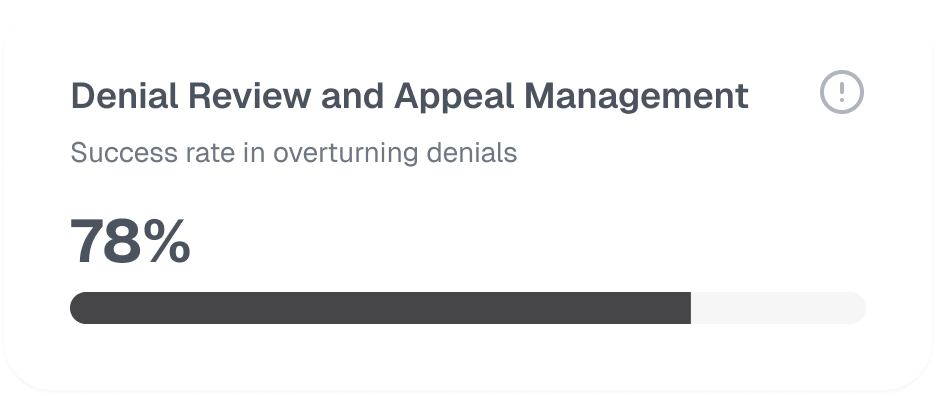

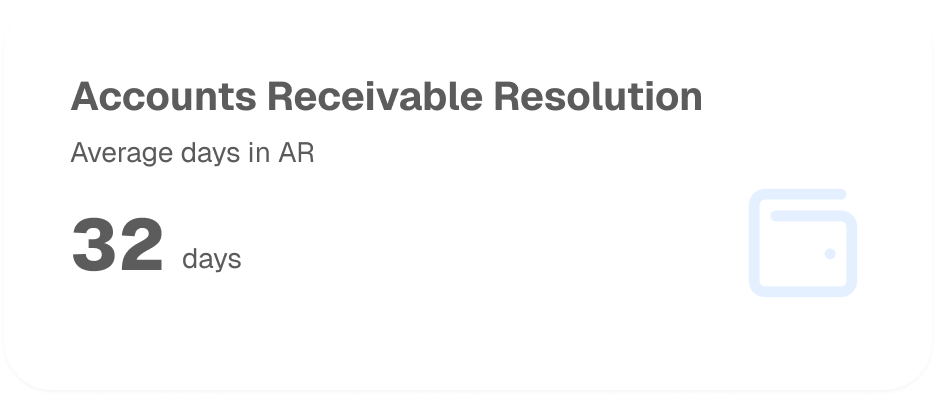

Is your top goal reducing bad debt and uncollectible claims? Our structured Accounts Receivable strategy identifies and rectifies denials promptly maximizing your net collections and keeping your revenue cycle healthy

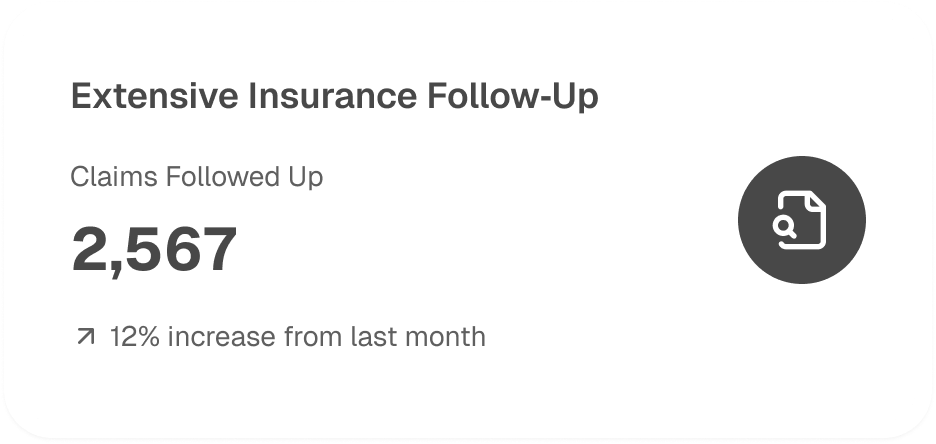

Our AR specialists are trained to scrutinize every unpaid or denied claim. By pinpointing root causes and utilizing strategic appeals, we minimize lost revenue and maintain strong payer relationships

We proactively manage outstanding balances and follow up on all overdue payments. This focus on timely resolution prevents cash flow interruptions and ensures a constant revenue stream

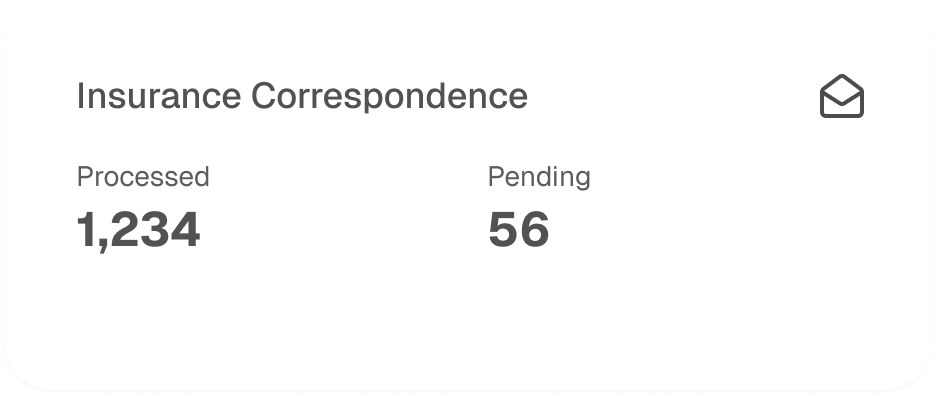

Staying in sync with insurance providers is crucial. We handle all correspondence, clarify policy requirements, and expedite approvals—keeping your claims moving forward without delays

Through consistent and methodical follow‑ups, our team ensures claims are processed correctly. We communicate with payers to address inquiries quickly and avert unnecessary denials

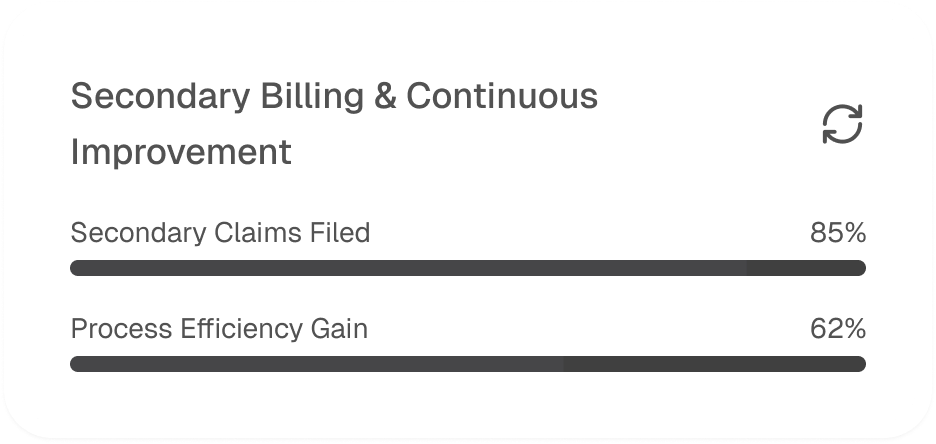

When primary insurance falls short, we initiate secondary billing to capture every legitimate reimbursement. Meanwhile, our Process Excellence Team reviews denied or delayed claims to drive continuous refinement across your revenue cycle