BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

Lock in your revenue. We manage invoices, track balances, and drive collections—so you can stay focused on your patients while we handle the rest

Schedule a CallAverage Days in A/R

A/R Over 90 Days Resolution Rate

Net Collection Rate

Effective A/R management is crucial for a healthy revenue cycle. Our timely follow-ups reduce aging balances, maximize reimbursements, and streamline collections. By leveraging proactive strategies and structured workflows, we help healthcare providers recover outstanding revenue faster and more efficiently.

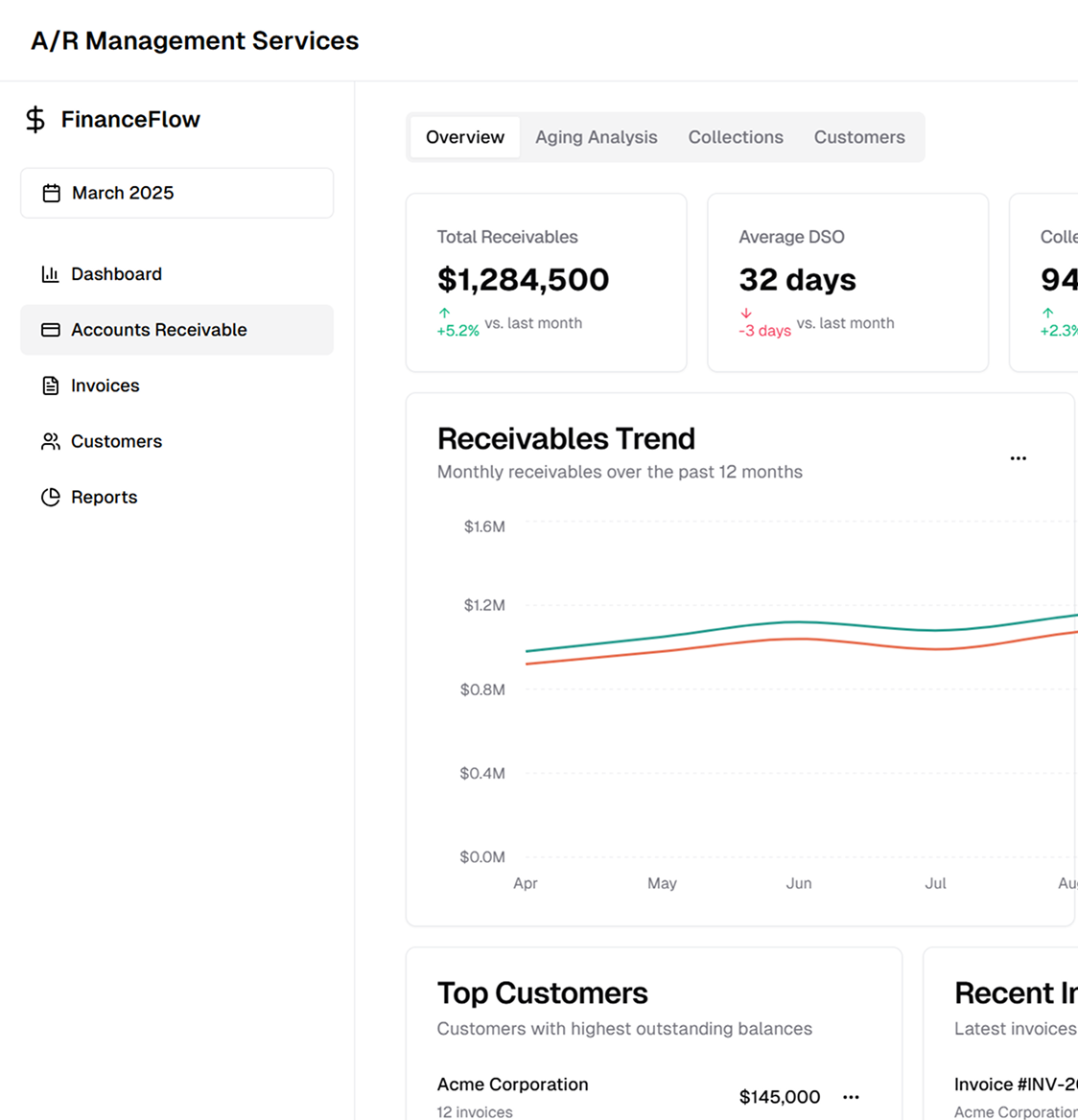

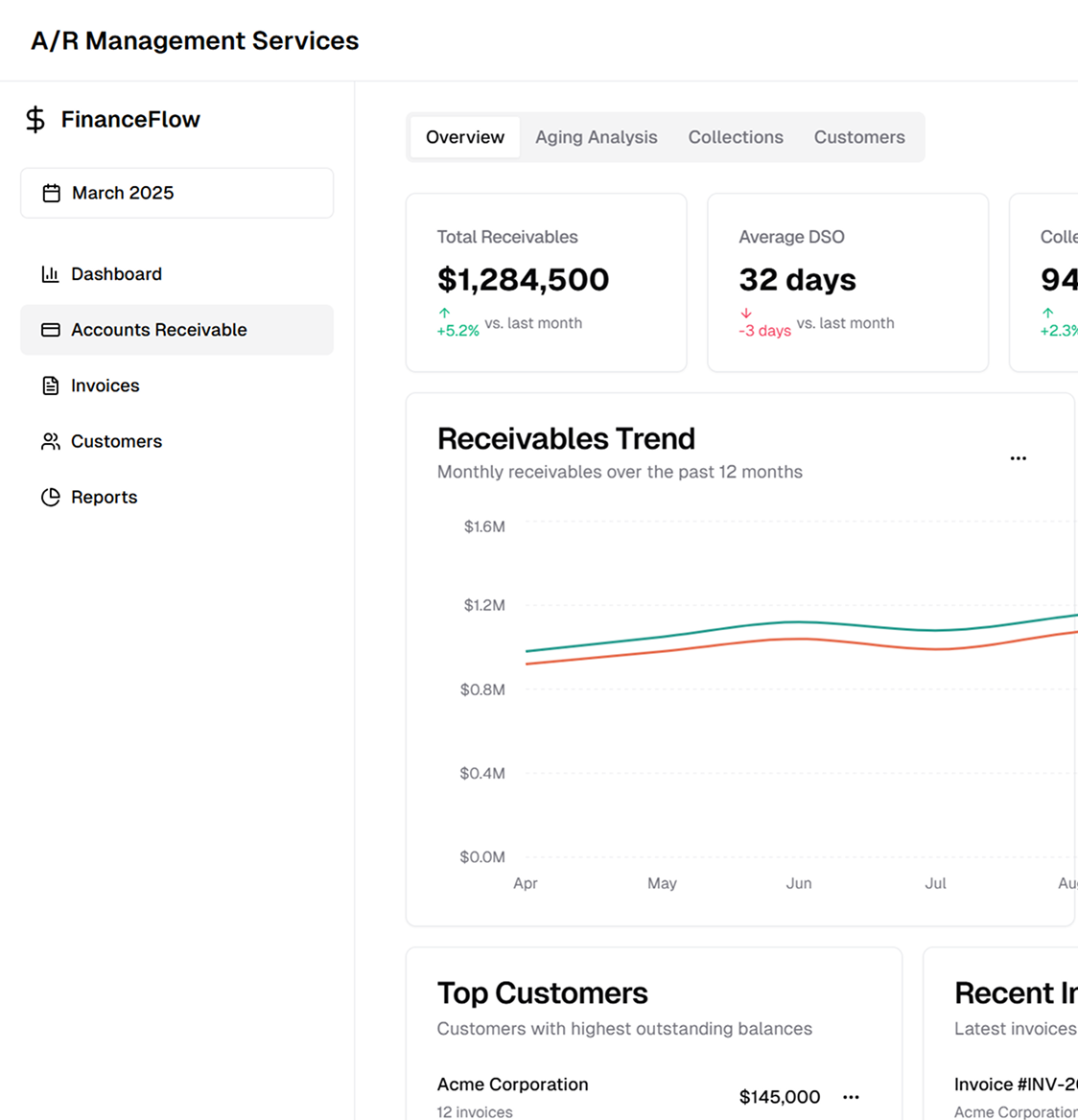

We conduct detailed A/R aging analysis, categorizing claims by 30, 60, 90, and 120+ days outstanding. Our reporting helps identify bottlenecks in collections and payer-specific delays, allowing for targeted recovery efforts.

Our team actively follows up with commercial insurers, Medicare, Medicaid, and third-party payers to resolve unpaid claims. We address denials, pending claims, and COB issues, ensuring claims move swiftly through adjudication.

We analyse denial patterns using CARC and RARC methods. Our structured appeal process includes resubmission, reconsideration requests, and Level 1 & Level 2 appeals, securing rightful reimbursements.

We assist patients with billing inquiries, balance resolution, and structured payment plans. Our approach ensures compliance with financial assistance policies and state regulations while improving self-pay collections.

Our early intervention strategies prevent accounts from becoming aged receivables. We coordinate with collection agencies and legal teams for overdue balances, ensuring compliant debt recovery practices.

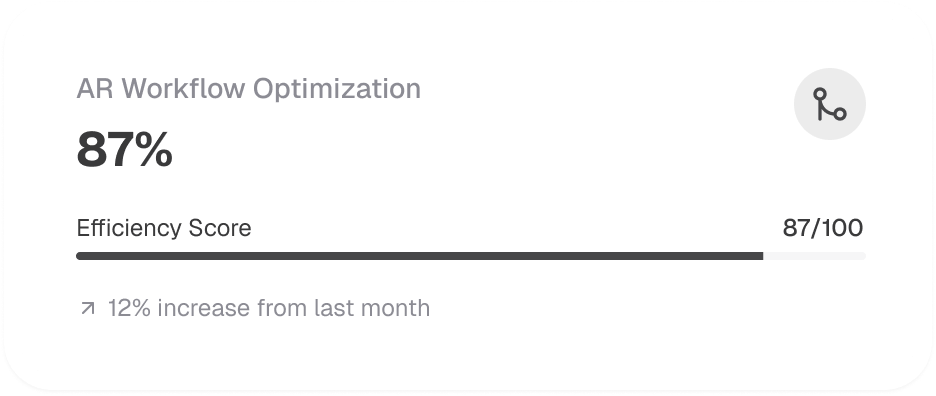

We implement structured workflows, advanced tracking systems, and payer-specific strategies to enhance A/R collections and reduce financial risks for healthcare providers.

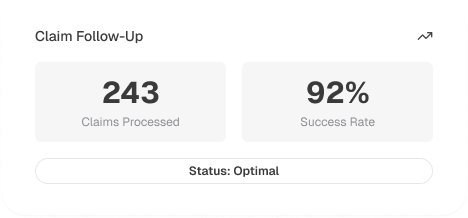

We streamline claim follow-up, payment tracking, and denial resolution with structured workflows that ensure timely account resolution.

Through EDI 276/277 transactions, we monitor claim statuses in real time, ensuring faster resolution of outstanding claims.

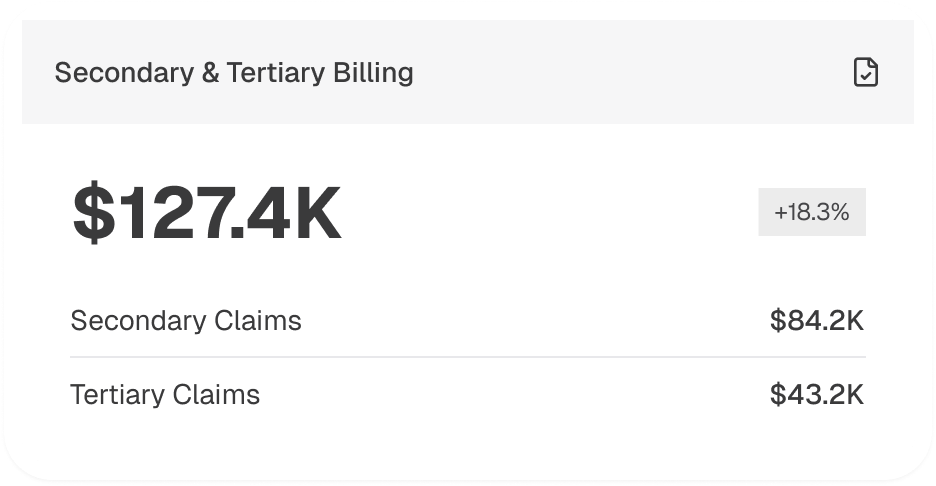

We submit claims to secondary and tertiary payers, collecting all eligible reimbursements before balances are transferred to patient responsibility.

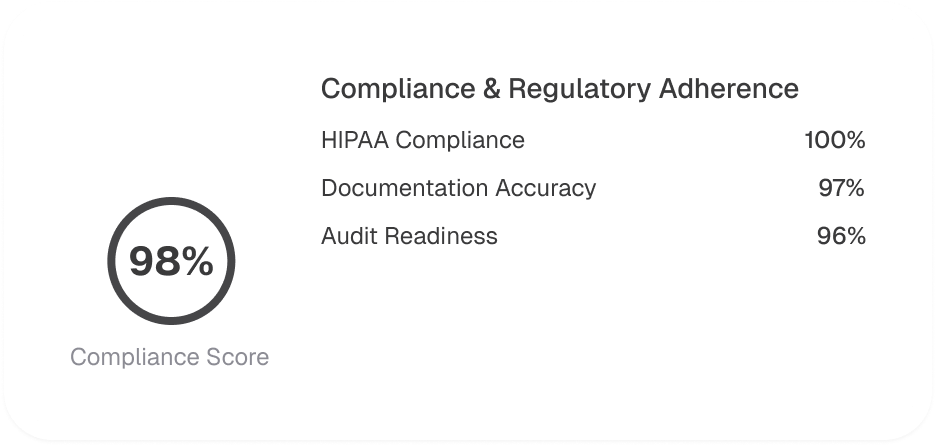

We follow HIPAA, CMS, and payer-specific policies, ensuring compliance with Medicare timely filing limits, Medicaid reimbursement rules, and Fair Debt Collection Practices Act (FDCPA) guidelines.

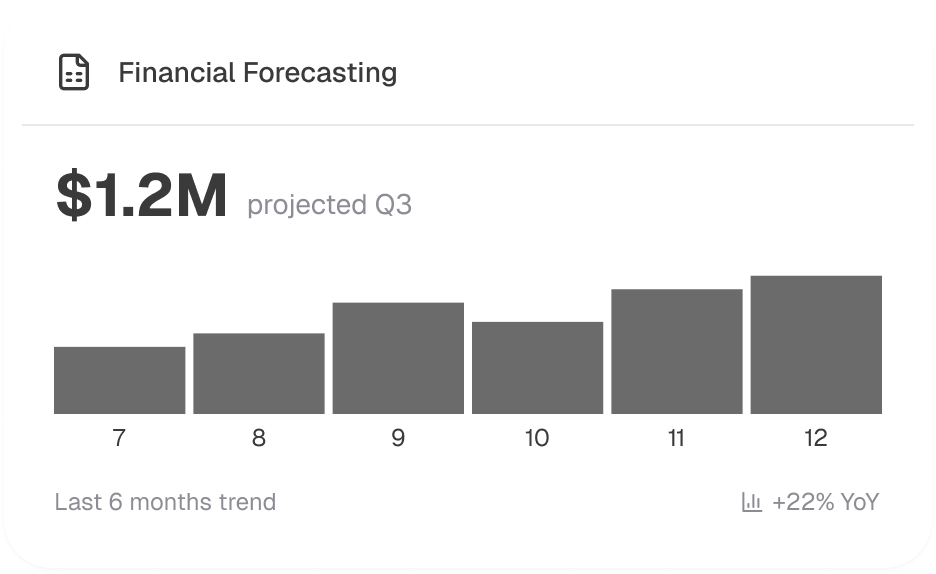

We provide customized dashboards, A/R aging trends, and revenue performance analytics, helping providers make data-driven decisions to improve financial health.