BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

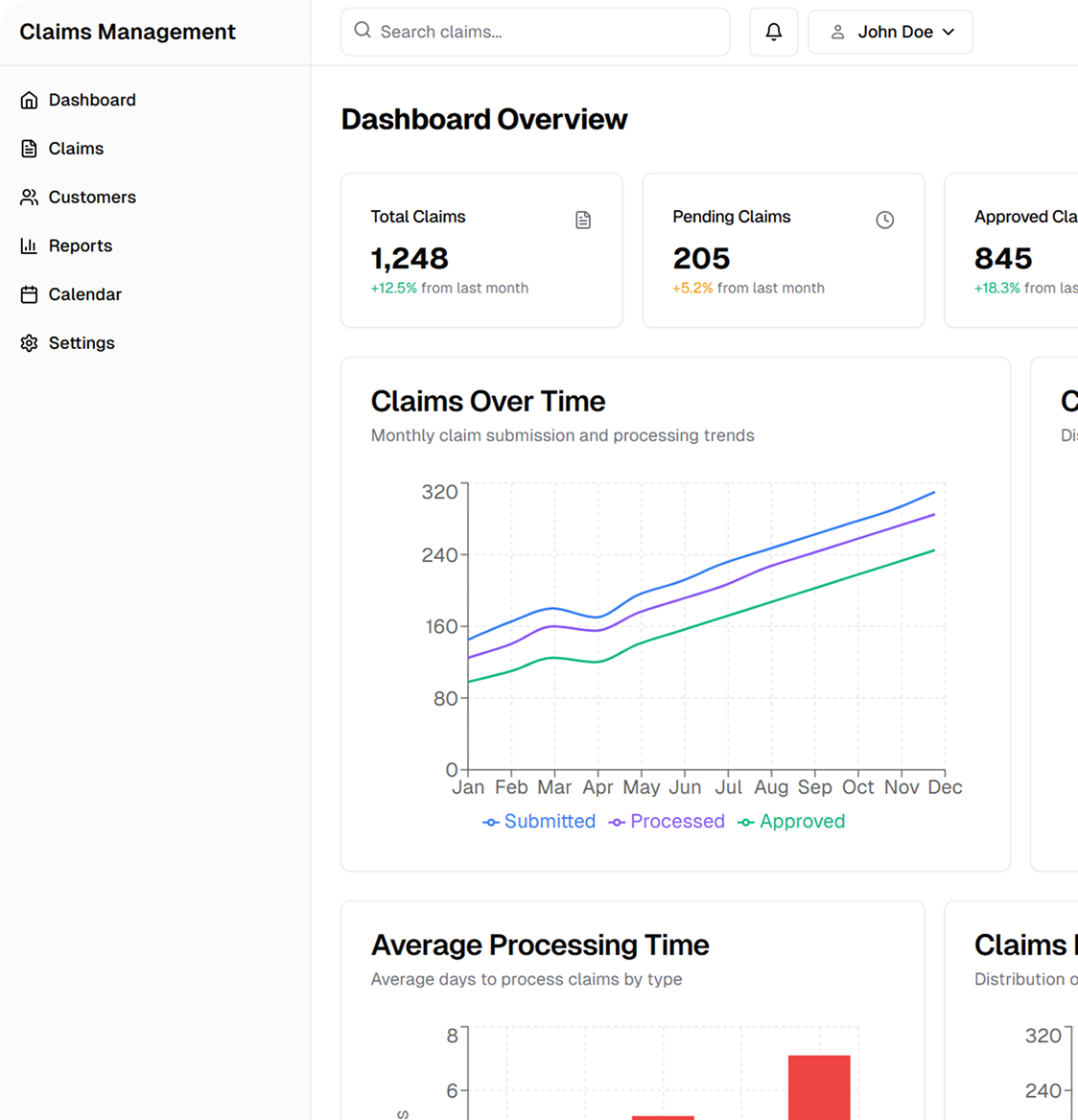

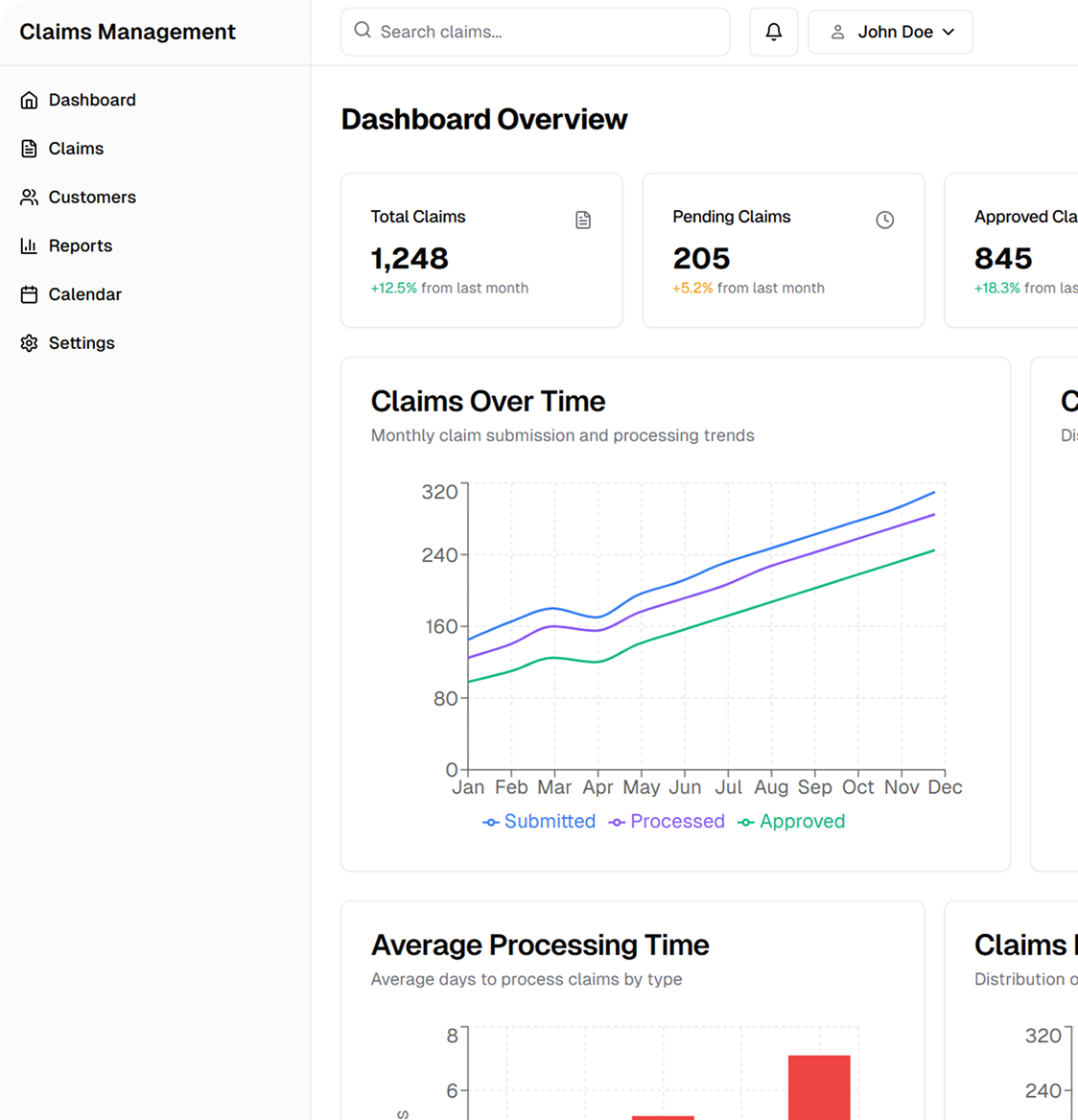

Our streamlined claims management handles everything—from submission to payout. Level up your revenue flow and keep your practice moving forward

Schedule a CallFirst-Pass Claim Acceptance Rate

Average Claim Processing Time

Claim Denial Rate

Our Claims Management Services ensure accurate submissions, timely reimbursements, and compliance while optimizing processing and supporting patient transparency.

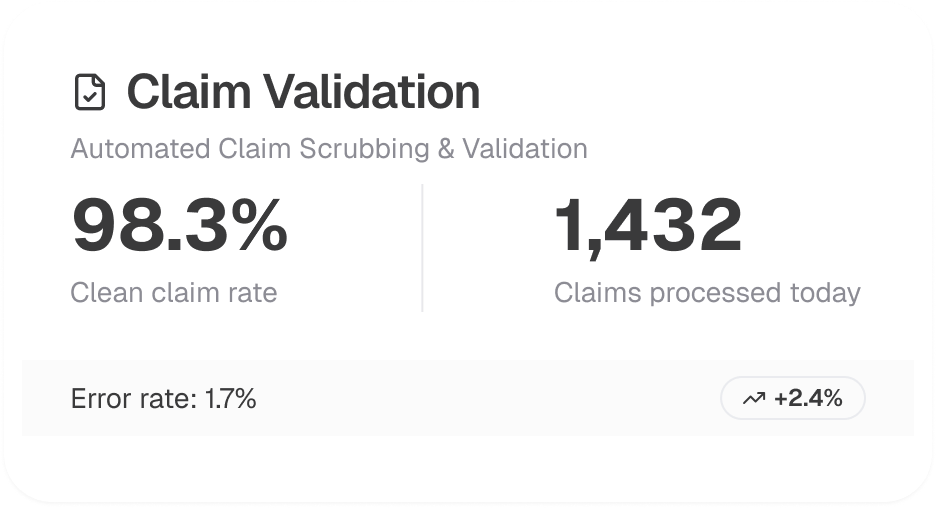

We manage electronic (EDI 837P/I) and paper claim submissions, ensuring they meet payer requirements and coding guidelines (ICD-10, CPT, HCPCS). Our rigorous claim-scrubbing process reduces errors and prevents unnecessary denials.

Before submitting claims, we verify patient coverage through real-time eligibility checks (270/271 transactions) and obtain prior authorizations to ensure compliance with insurance policies and reduce denials due to missing approvals.

We track and analyze denied or rejected claims, providing strategies for root cause analysis and resubmission. Our team manages appeals based on Claim Adjustment Reason Codes (CARC) and Remittance Advice Remark Codes (RARC) to secure proper reimbursements.

We use Electronic Remittance Advice (ERA 835) and manual payment processing to ensure accurate payment posting. Our reconciliation process helps identify underpayments, overpayments, and outstanding balances, ensuring financial accuracy.

We provide clear EOBs, detailed patient statements, and financial counseling to help patients understand their medical bills and available payment options.

Our structured claims management operations integrate with EHR/EMR systems, clearinghouses, and payer networks, ensuring efficient billing, reduced claim denials, and optimized revenue collection.

We verify claims for coding accuracy, missing information, and compliance with National Correct Coding Initiative (NCCI) edits, minimizing errors before submission.

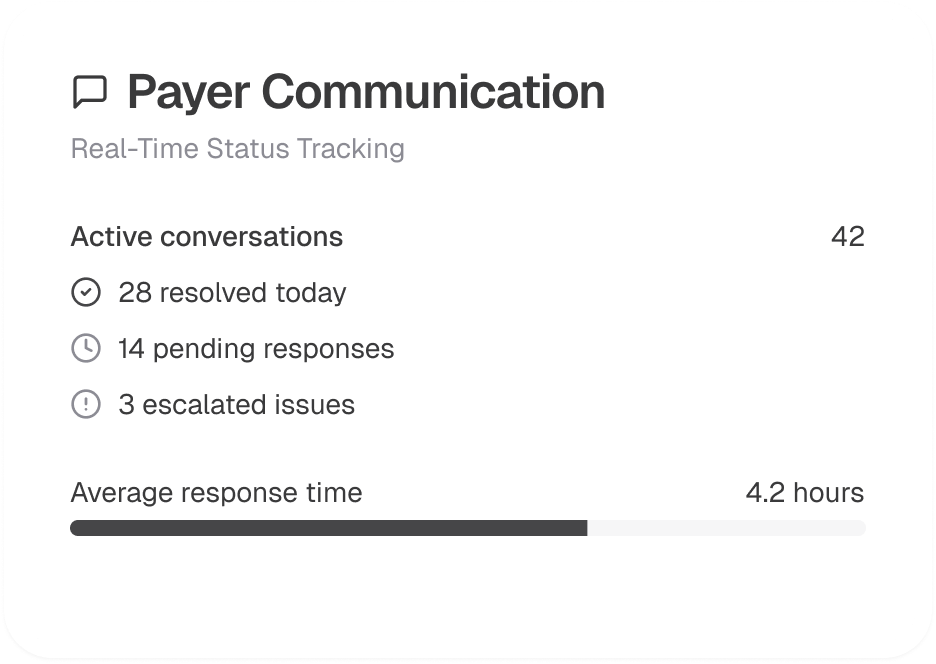

Through Electronic Data Interchange (EDI 276/277 transactions), we track claim status in real-time, ensuring proactive follow-ups on pending or delayed claims.

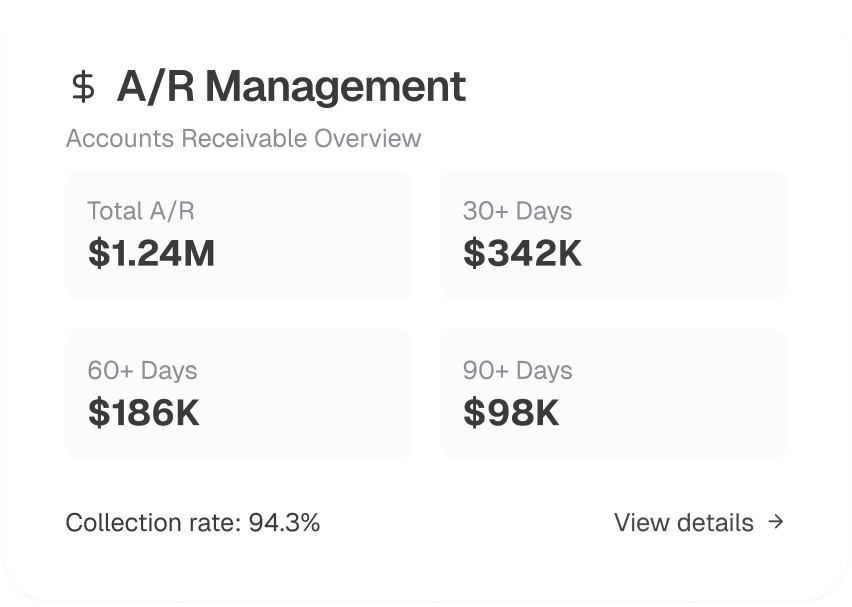

We conduct aging analysis, payer follow-ups, and timely resubmissions to maintain low Days Sales Outstanding (DSO) and maximize collections.

Our services adhere to HIPAA, CMS, and payer-specific guidelines, ensuring compliance with Medicare, Medicaid, and commercial insurance regulations to avoid audits and penalties.

We provide customized reports, denial trend analysis, and financial performance metrics, empowering healthcare providers with data-driven decision-making for revenue cycle optimization.