BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

No more hidden leaks. Our credit balance resolution ensures compliance, secures your revenue, and keeps your finances crystal clear

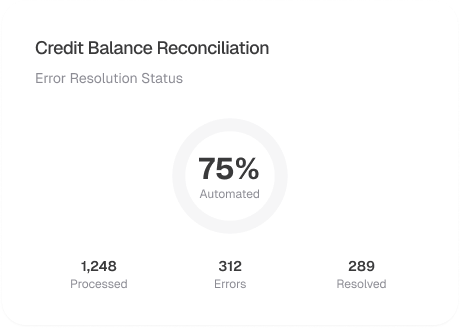

Schedule a CallCredit Balance Resolution Rate

Average Resolution Time

Credit Balance Error Rate

Our Credit Balance Resolution Services guarantee accurate identification, reconciliation, and resolution of all overpayments made by payers or patients, ensuring full compliance with CMS, OIG, and specific payer refund regulations

adjustments, or overpayments. Resolving these balances quickly helps avoid regulatory penalties and financial misstatements

Addressing recurring credit balances is essential for optimizing the revenue cycle. We analyze payment data, contract terms, and billing practices to identify errors in claim adjudication, contractual mispricing, and COB discrepancies

We validate all credit balances before processing refunds to prevent unnecessary reimbursements or write-offs. This enhances financial accuracy and provides a transparent audit trail for compliance

Each payer has unique refund and recoupment policies, requiring tailored workflows for efficiency and compliance. We manage offset processing, direct refunds, and payer-initiated adjustments, ensuring all transactions align with contracts and regulations

We efficiently manage patient overpayments by ensuring compliance with HIPAA, PCI-DSS, and financial regulations, processing refunds accurately while reducing administrative burdens for providers

Our approach to credit balance resolution integrates automated reconciliation, compliance workflows, and financial reporting to ensure accurate, transparent transaction handling

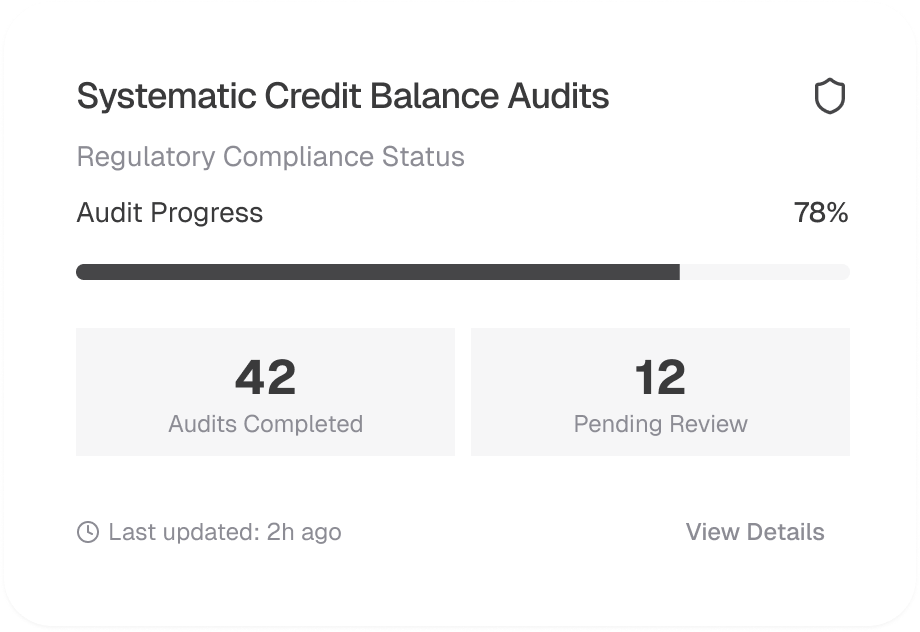

We conduct comprehensive audits to identify and categorize credit balances, ensuring compliance with CMS-838 reporting, OIG guidelines, and payer refund mandates. Our team ensures that all overpayments are validated and appropriately addressed to prevent compliance risks and avoid penalties

Our reconciliation system verifies payments, accounts, and adjustments against expected reimbursements, ensuring accurate resolution of credit balances. Billing discrepancies, incorrect adjustments, and coordination issues are flagged for correction, reducing revenue leakage and administrative burden

Different payers have varying policies on credit balance resolution. We customize refund workflows to comply with payer-specific guidelines, efficiently managing offset adjustments, direct refund processing, and payer recoupment requests

To prevent incorrect refunds, we verify patient overpayments by reconciling self-pay transactions, insurance reimbursements, and financial assistance programs. Our batch refund processing system ensures that high-volume transactions are handled efficiently, with a clear audit trail to maintain compliance and financial accuracy

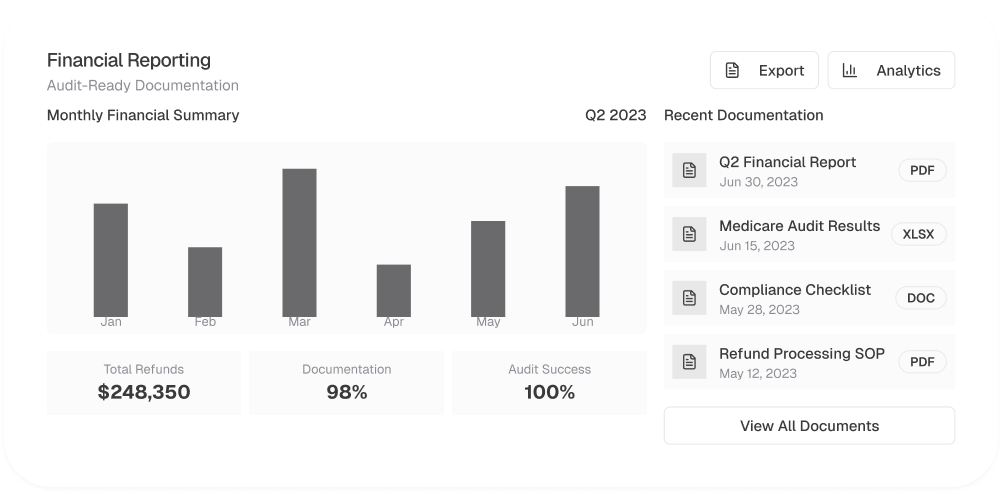

We ensure financial transparency with detailed reconciliation reports, audit logs, and refund tracking dashboards. Our real-time financial tools provide visibility into credit balances, refunds, and payer offsets, helping healthcare organizations optimize revenue cycles while staying compliant