BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

Accurate, Compliant, and Efficient Payment Posting for Seamless Revenue Cycle Management

Schedule a CallPosting Accuracy Rate

Average Payment Posting TAT

Adjustment/Error Rate

We specialize in multi-payer payment posting, high-volume transaction processing, and integration with leading EHR and RCM platforms to ensure that every payment is accounted for accurately and efficiently

We minimize manual entry errors and accelerate posting through direct integration with clearinghouses and payers. Our detailed EOB processing ensures complete revenue capture for non-automated payers, while our dual-layer verification process guarantees accurate allocation of payments, adjustments, and denials

Handling denied and adjusted payments requires careful attention to avoid revenue loss. Our team makes sure that all adjustments—contractual (CO), patient responsibility (PR), and other adjustments (OA)—are accurately identified and documented for appeals, resubmissions, or write-offs

We ensure payments match reimbursements and patient balances through regular reconciliations, identifying variances to prevent revenue leakage. Our end-to-end balancing verifies transactions against bank deposits for seamless revenue management

We ensure HIPAA and SOC 2 compliance, securing financial and patient data with RBAC, encryption, and controlled access to prevent unauthorized modifications

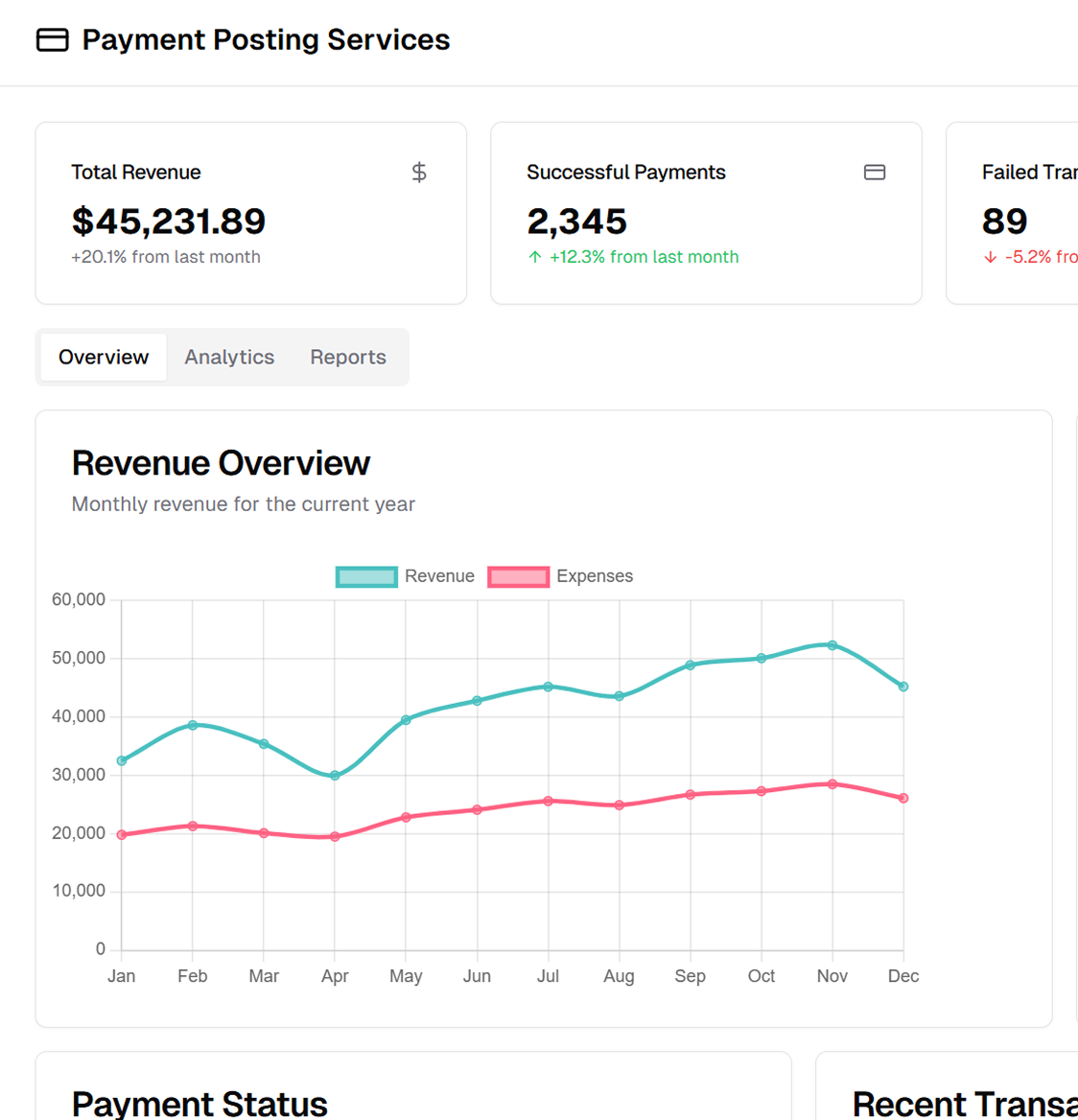

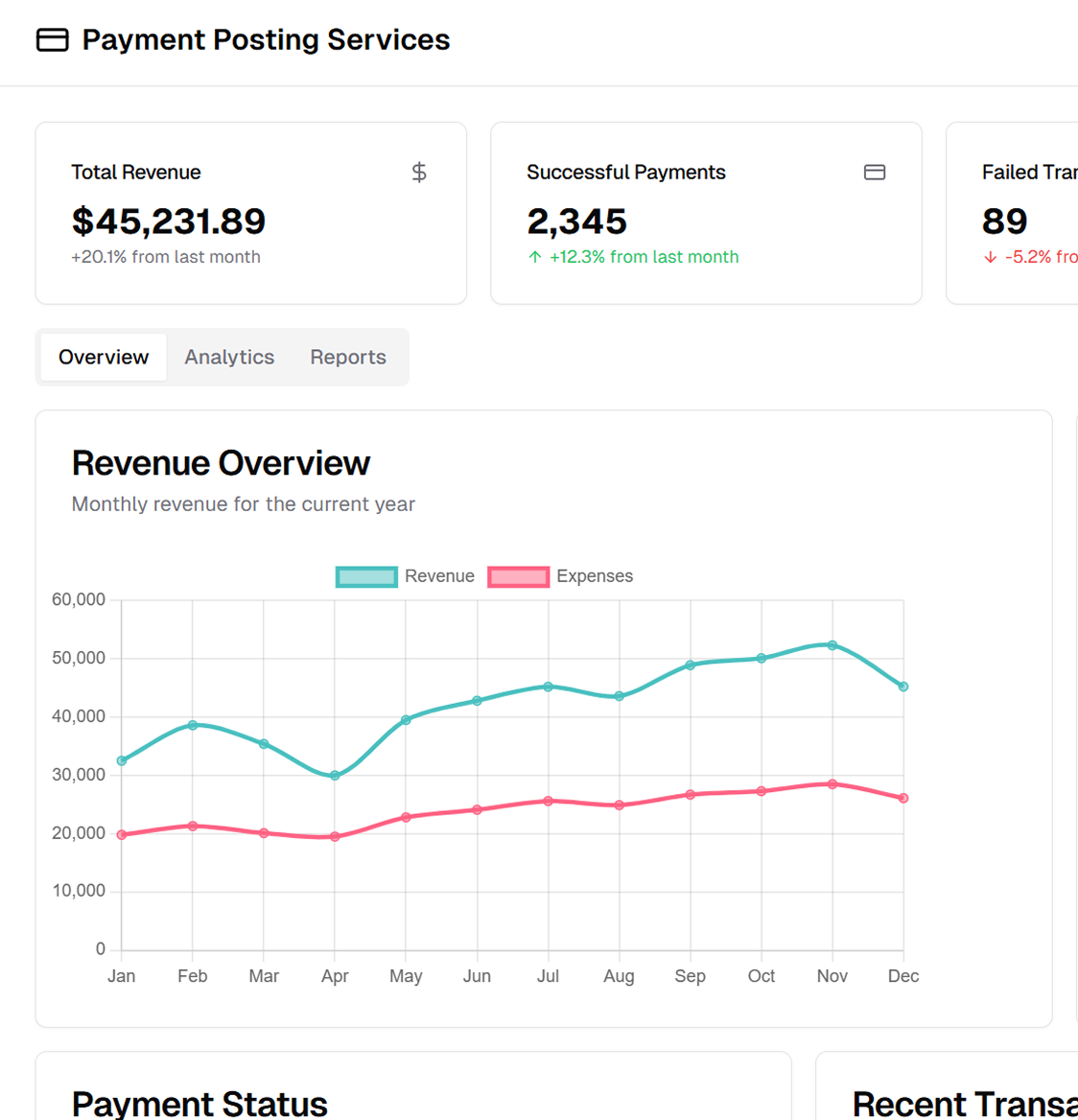

Our reporting and financial analytics offer insights into payment trends, revenue cycle metrics, and recovery opportunities. Denial trend reports aid root cause analysis, while tailored assessments and real-time dashboards enhance financial visibility

We employ professionals, automated tools, and best practices to ensure that payments are posted, reconciled, and reported accurately and promptly

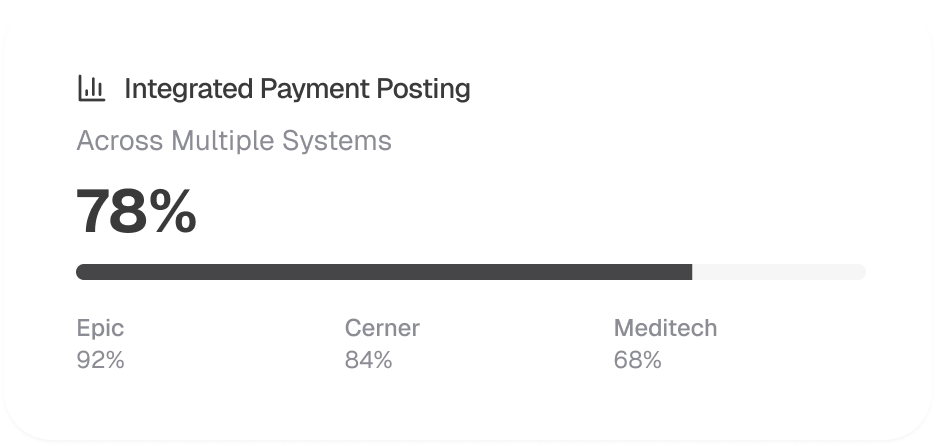

We integrate with major EHR, PMS, and RCM platforms for seamless payment posting and reconciliation through direct clearinghouse and payer portal integrations for faster posting, multi-system compatibility for consistent data, and centralized payment processing for multi-location providers

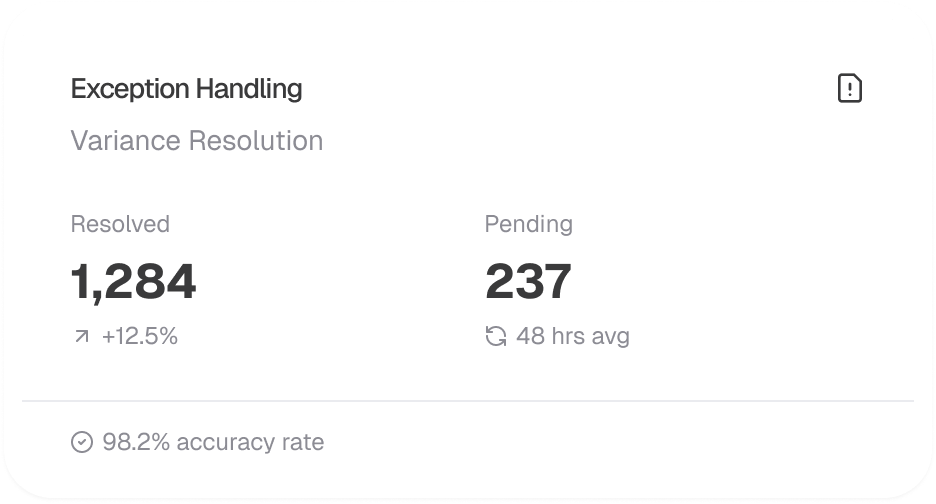

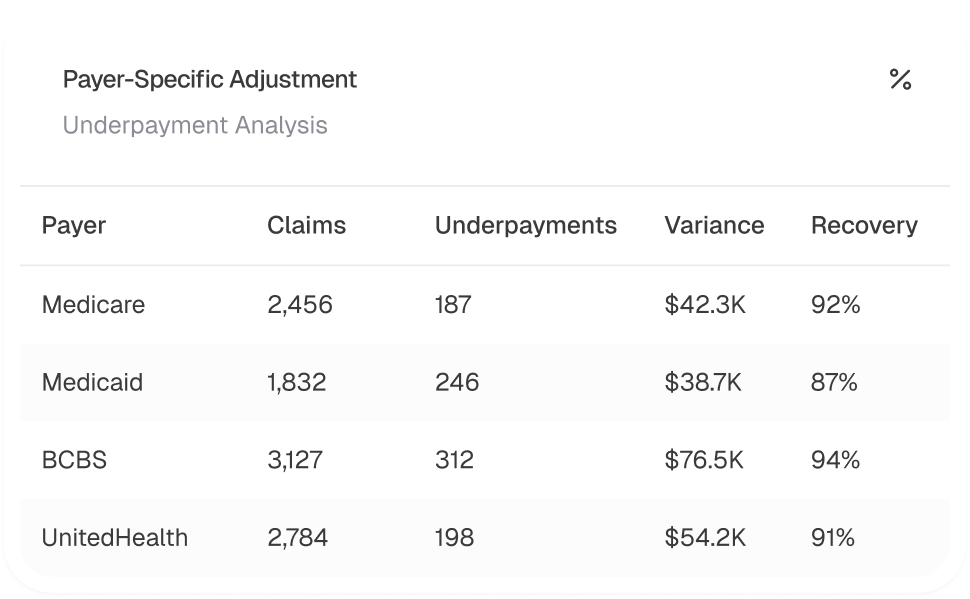

Our exception management team ensures accurate financial records by reviewing and rectifying misposted payments, unallocated funds, and unmatched transactions. We conduct daily variance audits to detect and resolve posting errors, follow payer-specific workflows for different insurance carriers, and prioritize significant underpayments through high-value discrepancy escalation pathways

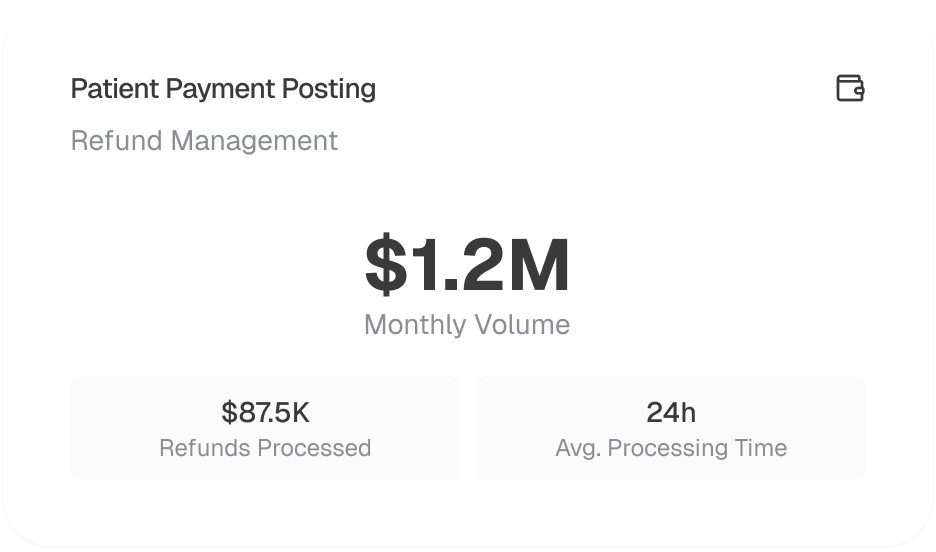

Patient payments, co-pays, and out-of-pocket expenses are accurately recorded and reconciled to maintain financial integrity and compliance, while overpayment detection ensures excess payments are identified and refunded appropriately

Our team prevents revenue loss by identifying underpayments and contractual adjustments, monitoring reimbursement discrepancies, expediting appeals through denial workflows, and ensuring consistent payment application with custom reconciliation templates

We integrate payment posting into the revenue cycle for faster reimbursements and accurate records, ensuring outstanding balances move promptly to the next payer. AR impact analysis highlights its effect on revenue, while customizable KPI dashboards track cash flow and payment delays for data-driven financial decisions