BLOG • Feb 19, 2025

Unlocking Revenue Potential: Why CARC Codes Are Essential for Denial Management

Maximizing Revenue Accuracy and Safeguarding Financial Integrity

Schedule a CallUnderpayment Rate

Average Underpayment Recovery Time

Variance Identification Accuracy

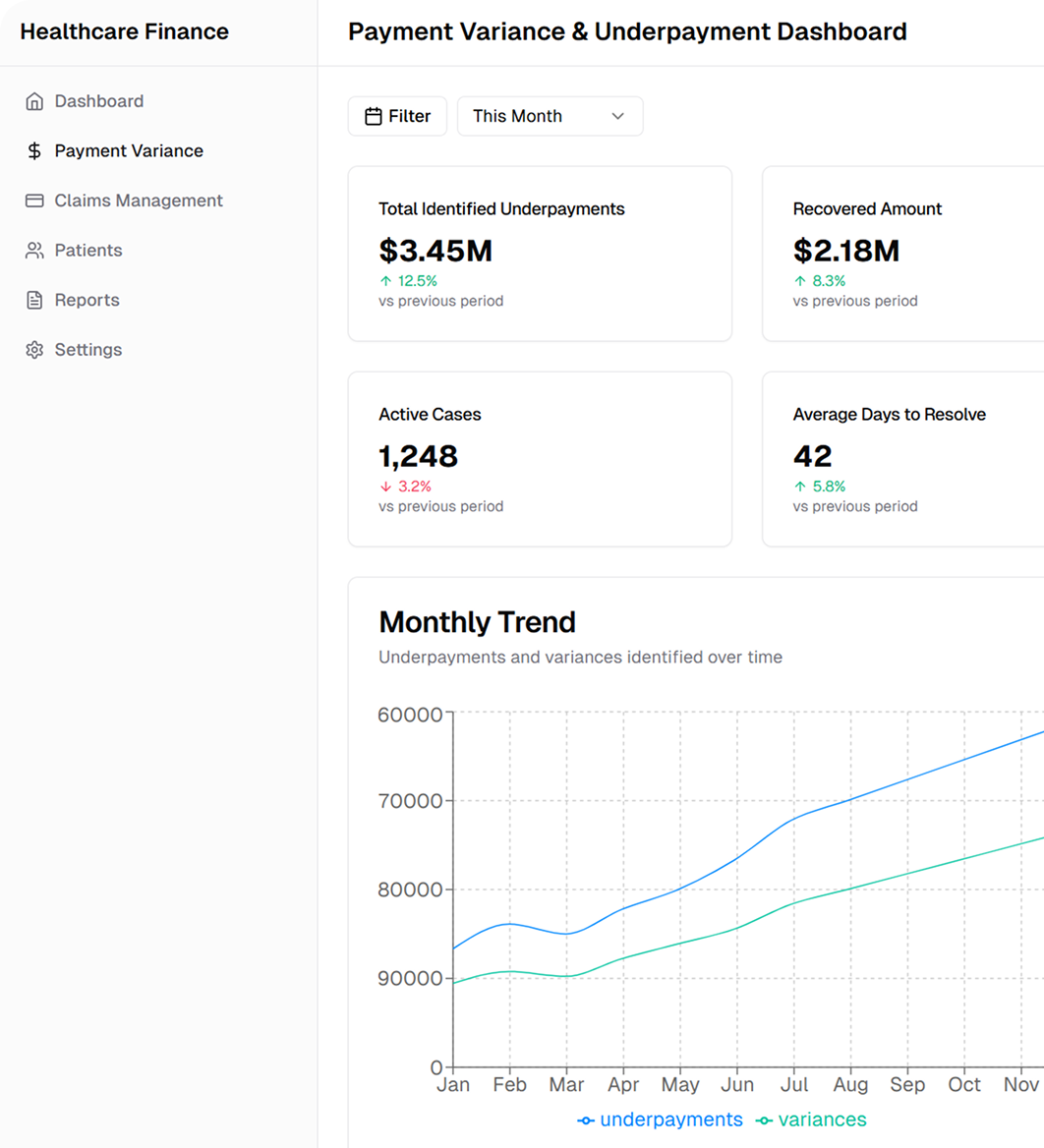

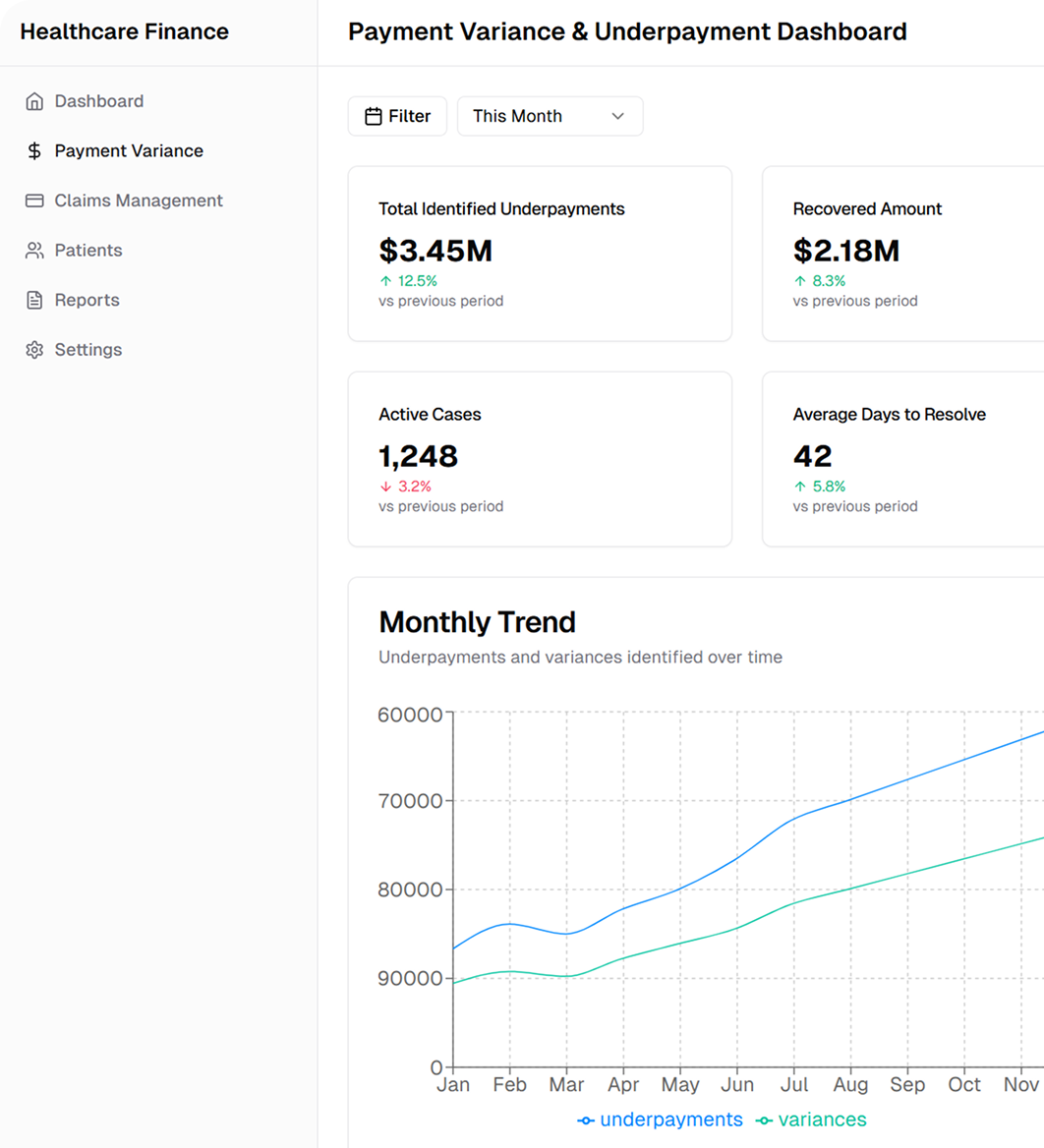

Payment Variance and Underpayment Services are designed to identify, analyze, and correct discrepancies between expected reimbursements and actual payments received

Payment variance refers to the gap between the reimbursement anticipated based on payer contracts and the actual payment received. This analysis helps pinpoint the causes of discrepancies, such as contractual adjustments and payer-specific factors

Content – Underpayments occur when reimbursements fall short of the agreed-upon rates. This section focuses on methods to detect underpayments resulting from claim processing errors, misinterpretation of policies, or system limitations

Utilizing real-time data analytics, automated claim scrubbing, and integrated EHR systems enables healthcare providers to monitor payment flows effectively. These tools help promptly identify variances and underpayments across all claims

Accurate contract management and regular auditing are key to minimizing payment discrepancies. This involves aligning payer contracts with billing practices, monitoring compliance, and initiating renegotiations when necessary

Timely detection and resolution of payment discrepancies can significantly improve cash flow. By implementing targeted recovery strategies and dispute resolution processes, organizations can reduce revenue leakage and enhance financial performance

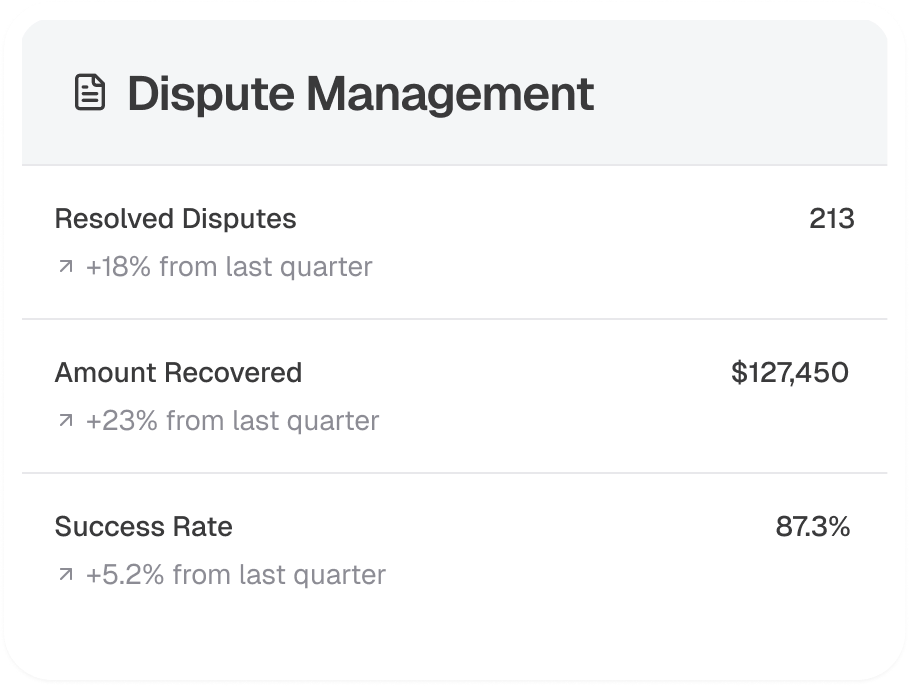

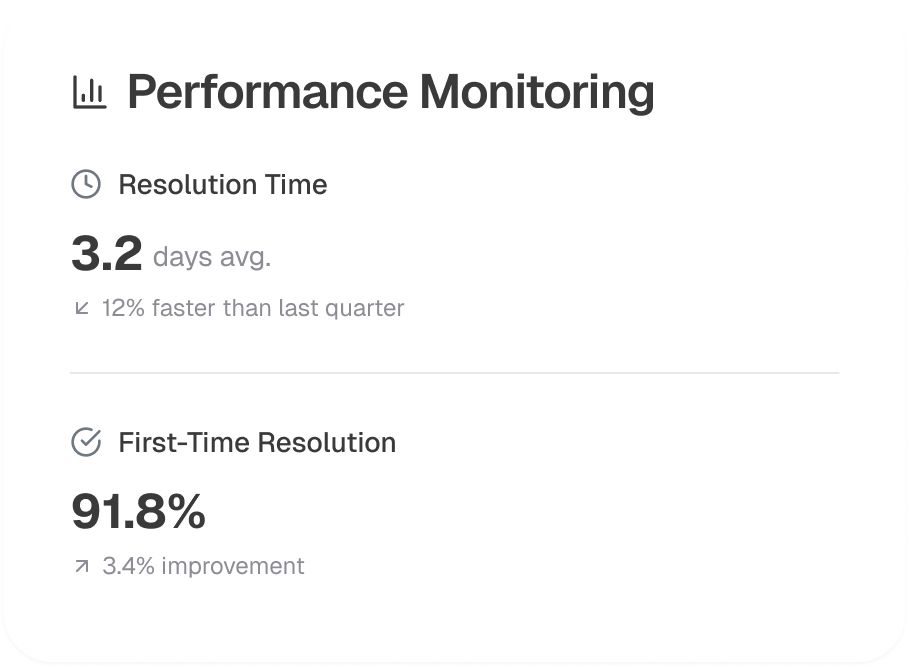

A systematic operational framework is essential for addressing payment discrepancies. This framework integrates data collection, automated analysis, dispute management, and continuous performance monitoring to ensure efficient recovery and financial integrity

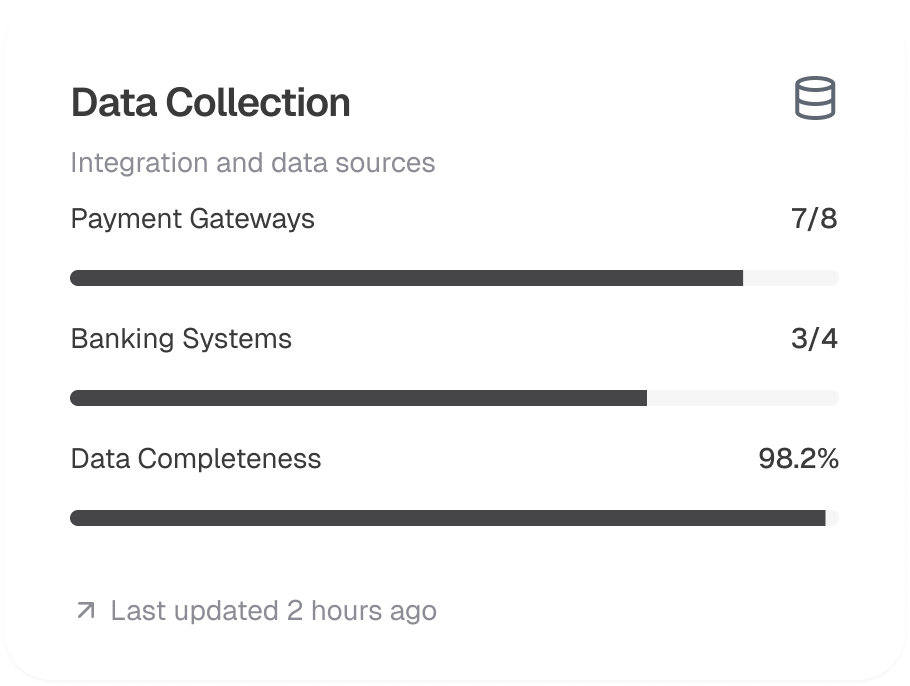

Gather comprehensive claim data from billing systems and integrate it with contractual details to establish a baseline for expected reimbursements

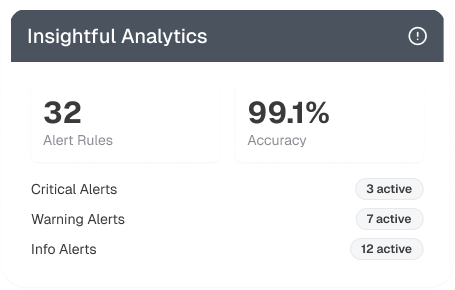

Implement advanced analytics tools to continuously monitor payment data, automatically flag discrepancies, and generate real-time alerts for prompt review

Develop a structured dispute resolution process that includes documenting variances, preparing appeal packets, and directly communicating with payer representatives to resolve issues

Track key performance indicators (KPIs) such as variance percentage, underpayment recovery rate, and resolution turnaround time to assess the effectiveness of financial recovery efforts

Invest in regular training and process reviews to adapt to evolving payer policies and technology advancements, ensuring ongoing efficiency and compliance in managing payment discrepancies